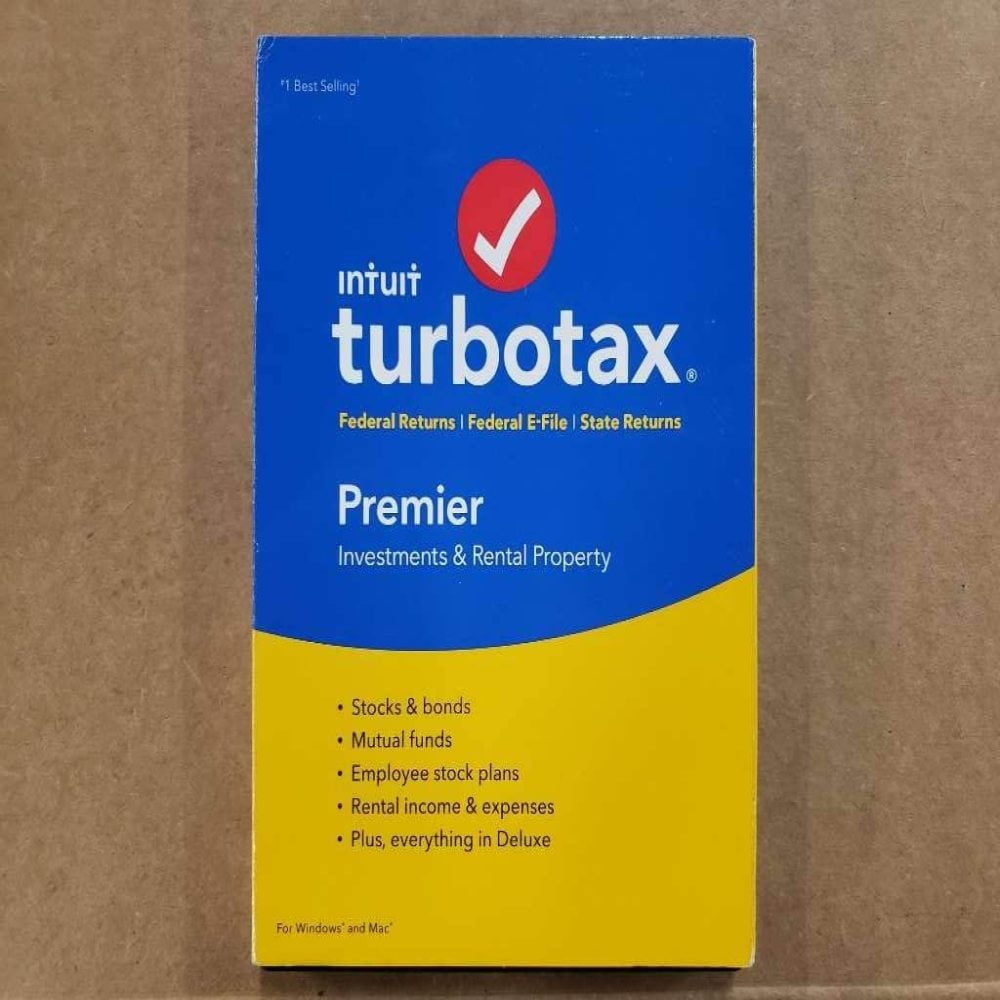

Instead of having to sift through their products on your own, we’ve categorized them for you so you can easily find the best fit. These companies provide the most diverse range of tax software products, but not all of them are right for every filer. In our breakdown, we’ve highlighted tax software solutions from both Intuit and H&R Block. Make sure the software you choose is compatible with your preferred operating system. Your tax software will be compatible with either a PC or Mac. If this is something you want help with, make sure your software includes it. Federal and State ReturnsĮveryone needs to file federal and state taxes, but some basic tax software options don’t include state returns. Those who are self-employed, those who have complicated tax situations, and businesses will all have different tax needs than someone filing personal taxes and may require more complex software.

Those who have simple tax situations will likely be fine with cheaper or more basic software. Here’s what to keep in mind before buying: Your Filing NeedsĮveryone’s tax return is going to be slightly different. When you’re looking at tax software options, there are going to be a few factors you’ll want to consider. Take a look and pick the right one for your tax needs! What to Consider Below, we’ve highlighted some of the best tax software options available. With tax software, you can save hours in the filing process while avoiding the high cost of hiring a tax preparer. If you want to make sure your taxes are done right and that you get the biggest refund possible (or at least owe the smallest amount of money possible), the right tax software can be a game-changer. Plus, getting a nice big tax refund can make the annoyance of filing a little easier to swallow. Most people don't exactly enjoy having tax season roll around, but filing your taxes is still a task that needs to be completed in a timely manner each year.

0 kommentar(er)

0 kommentar(er)